PM Youth Business & Agriculture Loan Scheme 2025 has been relaunched to benefit farmers in the agriculture field with flexible repayment plans.The Government of Pakistan has always been committed to empowering its youth, farmers and business people.This initiative provides financial support to small and medium farmers, startups and farmers to contribute to Pakistan’s economic growth.This scheme is a golden opportunity for the youth who want to start their own business and promote agricultural productivity.This scheme is to make it easier for young people to pay low interest rates and make the repayment method easier.

Objectives of PM Youth Business & Agriculture Loan Scheme 2025.

This scheme was launched with a clear vision to support the farmers and youth of Pakistan.Its main objectives include:

✅ It encourages young people to start small businesses and establish their own startups.

🌾 Provide to farmers with easy access to finance for modern farming techniques, seeds, fertilizers, and equipment.

💼 Employment opportunities are provided by promoting self-employment and small industries.

🏦 Ensure access to banking and loan facilities for youth and rural communities.

📈 Support small businesses and agriculture to contribute directly to Pakistan’s GDP.

Also read.http://punjab laptop scheme phase 2Key Features of the PM Youth Business & Agriculture Loan Scheme 2025.

The Youth Business & Agriculture Loan Scheme 2025 has many attractive features which are beneficial for those applying for it.

🧾 Pakistani citizens between the age of 21 and 45 years can apply.

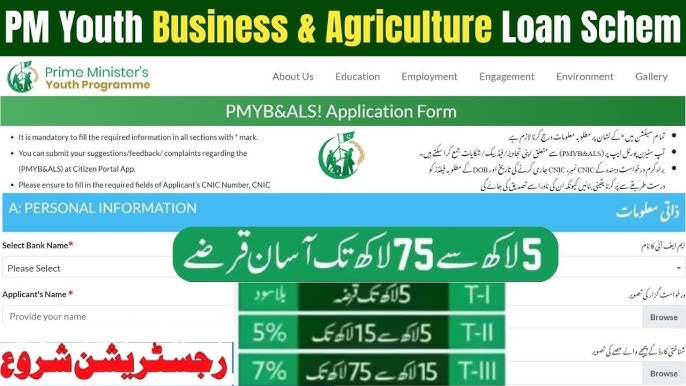

💰 Financing ranges from PKR 0.5 million to PKR 7.5 million depending on the category.

📉 Loans come with markup rates reduced starting from 0% to 7%.

⏳ Flexible repayment period can exceed 8 years with a grace period option.

🌐 Cover sectors like agriculture, livestock, fisheries, trading, manufacturing, service, and IT startups.

👩💼 To promote gender equality, 25% quota will be reserved for women entrepreneurs.

🔑 Small-scale financing becomes available without collateral, making it easier for young people to apply.

☪️ Sharia-compliant loans are also available.

Also read.https://schemeportal.pk/Loan Categories for PM Youth Business & Agriculture Loan Scheme 2025.

This scheme will be divided into three categories to ensure inclusivity for both small farmers and young entrepreneurs.

Tier 1 (T1) Loans.

💵 Loan amount up to PKR 0.5 million.

🆓 Markup rate 0% (interest free).

🌱 Purpose for micro-enterprises, the need for small agriculture, and startups.

🔒 Collateral not required.

Tier 2 (T2) Loans.

💰 Loan amount will be reduced from PKR 0.5 million to PKR 1.5 million.

📉 Markup rate 5% per annum.

🎯 Purpose for medium-scale businesses, livestock, modern farming, and present business expansion.

🏦 Collateral as per bank requirements.

Tier 3 (T3) Loans.

💵 Loan amounts ranged from PKR 1.5 million to PKR 7.5 million.

📊 Markup rates 7% per annum.

🚀 Purpose for large-scale businesses, agricultural machinery purchase, processing facilities, and technology-driven startups.

📑 Collateral required.

How Farmers Benefit from the PM Youth Business & Agriculture Loan Scheme 2025.

🌾 Through this scheme, farmers can purchase seeds, fertilizers, and pesticides.

💧 Through this scheme, irrigation systems and solar tube wells will be installed for the farmers.

🚜 Through this scheme, farmers can buy farming machinery and tractors.

🐄 Through this scheme, farmers can benefit from livestock farming, poultry, and fisheries.

🏬 Through this scheme, storage facilities for crops and produce will be set up.

Application Process for PM Youth Business & Agriculture Loan Scheme 2025.

🌐 For online application, visit the official PM Youth Programme Portal and fill out the online form.

📑 Required documents for applying: Upload CNIC, business proposal, and basic financial information.

🏦 Participating banks can be selected for application such as NBP, BOP, Bank Alfalah, and Meezan Bank.

✔️ The eligibility and business idea of the applicant are reviewed by the bank.

💸 Once approved, funds will be transferred to the account within a week.

Success Stories from Previous Batches.

Young entrepreneurs to establish e-commerce businesses and IT startups.

Farmers should adopt modern techniques that double crop production.

Women-led businesses in handicrafts and livestock flourished.

Youth in rural areas to start dairy farms and poultry businesses.

Benefits of PM Youth Business & Agriculture Loan Scheme 2025.

🌟 To empower youth by providing them financial independence.

🌾 Farmers will be supported to improve productivity and income.

💡 Technology-driven startups will be encouraged to promote innovation.

👩👩👧 Special focus will be given to women and rural communities.

🧑🏭 Thousands of unemployed people got jobs nationwide.

🚜 Boost small-scale industries or agriculture.

Final Thoughts.

PM Youth Business & Agriculture Loan Scheme 2025 is not just a financial assistance program but also an empowerment, self,reliance and prosperity.The PM Youth Business & Agriculture Loan Scheme 2025 supports both agriculture and business. It allows small businesses to be started or farmers to receive agricultural subsidies.This is a perfect scheme for both small businesses and farmers through which they can fulfill their dreams.Apply today and take the first step towards a bright future.

Who is eligible for the loan?

All Pakistani citizens aged 21–45 years (18 years for agriculture) with a valid CNIC.

What is the maximum loan amount?

Up to PKR 7.5 million depending on the category.

Do I need collateral for the loan?

For small-scale loans (T1), no collateral is required. Higher loans may require security.

How long is the repayment period?

Up to 8 years, including grace period.

Can women apply for this scheme?

Yes, 25% quota is reserved for women entrepreneurs.